Consultancy &

Business Advisory.

RExperts contributes to the professionalism of the Brazilian real estate financial market, assisting commercial real estate investors/operators and property owners through tailored solutions based on our insightful and strategic expertise.

Our cross-border Consultancy & Business Advisory services range from financial analyses, technical and legal due diligence, market research, tax structuring, and business case development to project delivery, capital and debt advisory, transactions, assistance on negotiation and completion.

Our positioning as an independent firm, allied with the didactics coming from our educational division, provides objective and unbiased results and a unique combination of expertise in the Brazilian real estate and capital markets.

OUR CLIENTS.

SPECIALISTS

Companies, real estate investment trusts (REITS), managers and professional investors that, despite having real estate as their core business, require support in specific transactions

PROPERTY OWNERS

Family groups, family offices, companies or investors with substantial real estate assets for which real estate is not their main line of business

HOW CAN WE HELP YOU?

1 Real Estate Monetization.

2 Financial Analytics & Modeling.

3 Business Advisory.

4 M&A and Divestments.

5 Private Equity.

1 Real Estate Monetization.

Unlock all the embedded real estate value of individual properties or entire portfolios to reach their best real estate monetization alternative.

We guide our clients to enhance their decision-making process to higher returns and lower risks, so they can find the best strategic path to follow, based on a complete study involving technical, environmental, legal, commercial, and economic-financial feasibility.

Technical Feasibility

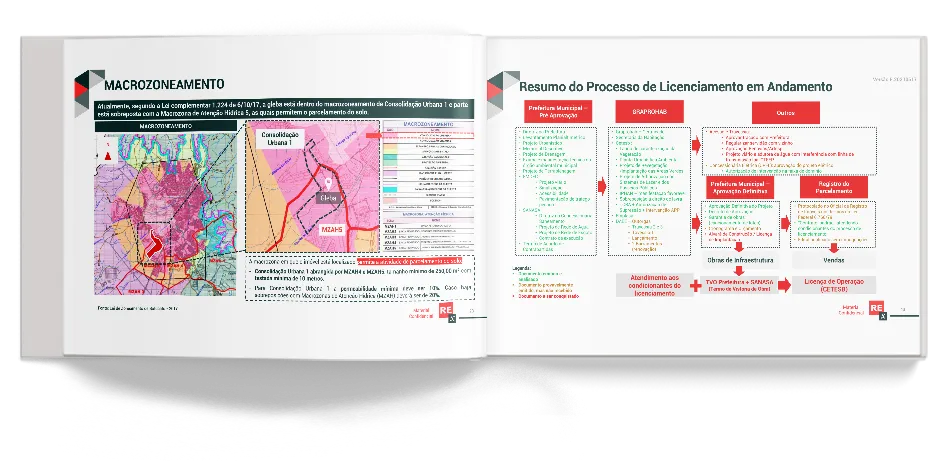

In terms of legislation, architecture and engineering, is it possible to develop the desired development?

What are the constructive parameters for the development?

This step comprises understanding the project's limitations, which define issues such as:

- Modalities of permitted developments;

- Analysis of the Laws of Land Use and Occupancy and Zoning;

- Building potential and architectural limits;

- Deployment studies with the usable areas;

- Licensing process;

- Road accesses to the Property;

- Possible restrictions by water and sewage utilities, power lines, road accesses, gas pipelines, among others;

- Parametric estimates of development costs.

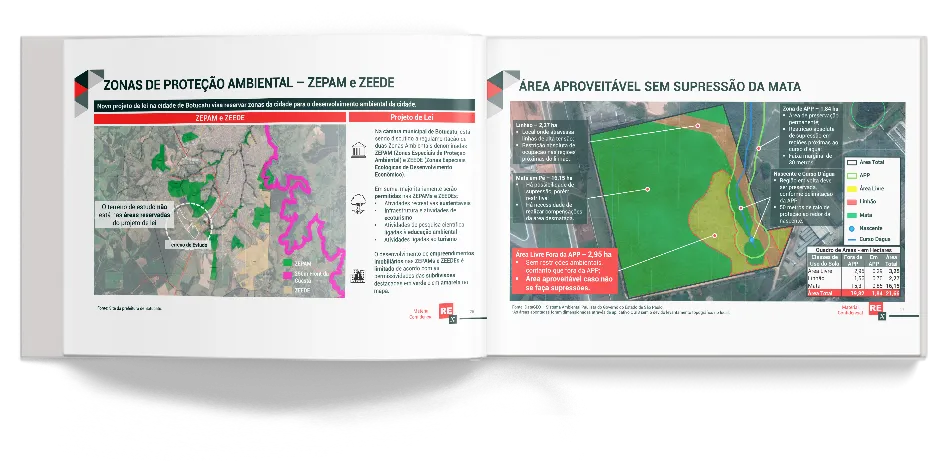

Environmental Feasibility

Does the property have any environmental aggravating factors?

What impact can this have on the project?

Risk mitigation seeking to evaluate important environmental aspects related to the project, caused by:

- Streams, rivers, lakes, springs;

- Forests, arboreal groupings, isolated trees;

- Verification of registries with environmental authorities to identify risk of soil contamination by industries, gas stations, garbage dumps, debris, scrap iron, etc;

- Consultation of the rural environmental registry at INCRA (National Institute for Settlement and Agrarian Reform);

- Consultation to IGC (Geographic and Cartographic Institute of SP) maps;

- Areas of environmental protection and permanent preservation.

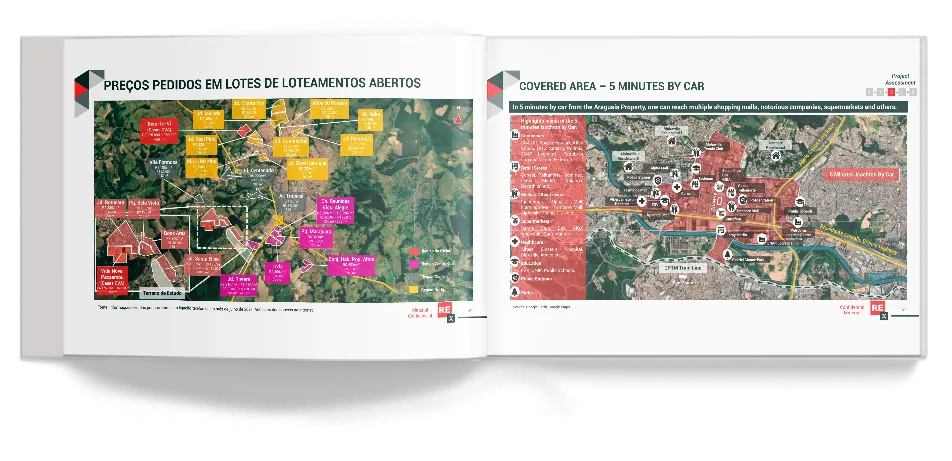

Market Research

Is the product to be developed demanded?

At what price and payment terms?

To understand this point, a compilation of information regarding the city, target market, product, and prices is surveyed:

- Demographic and economic characteristics of the city;

- National, state, and local comparisons;

- Vocation of the area;

- Characteristics of developments in the surrounding region;

- Evolution of the city and the surroundings of the property in the last 10 years;

- Characteristics of supply and demand for launches, sales and inventory in the region of the property;

- Asking prices for real estate in the region, with different types of properties being exposed for sale and/or rent;

- Formats of payment practiced in the market of the region (down payment, construction installments, on-lending, direct financing);

- Interviews with local players in the real estate market (brokers, developers, city hall, landlords).

Legal Feasibility

Is the business economically profitable and financially possible?

How can risks be mitigated and investment conditions improved?

- This stage consists of projecting cash flows, calculating economic and financial indicators, and sensitivity analyses to assess the feasibility of the business plan, which will comprise:

- Project development schedules;

- Economic-financial analyses of the real estate business options;

- Comparison of the results of the possible typologies;

- Simulations in different scenarios;

- Results from each stakeholder's point of view of the project (landowner, entrepreneur, and investors);

- Nominal and real cash flows;

- Main financial indicators (IRR, MOI, NPV, Cash Exp.);

- Indication of the feasible terms for structuring the business involving the negotiation of the property (purchase / sale / swap) and fundraising (equity and/or debt).

Economic Feasibility

Is the business economically profitable and financially possible?

How can risks be mitigated and investment conditions improved?

This stage consists of projecting cash flows, calculating economic and financial indicators, and sensitivity analyses to assess the feasibility of the business plan, which will comprise:

- Project development schedules;

- Economic-financial analyses of the real estate business options;

- Comparison of the results of the possible typologies;

- Simulations in different scenarios;

- Results from each stakeholder's point of view of the project (landowner, entrepreneur, and investors);

- Nominal and real cash flows;

- Main financial indicators (IRR, MOI, NPV, Cash Exp.);

- Indication of the feasible terms for structuring the business involving the negotiation of the property (purchase / sale / swap) and fundraising (equity and/or debt).

We present the simulations in an illustrative and didactic way, with tables and graphs for a better understanding of the results and to provide insights into possible improvements in the project, such as cash exposure reduction and risk mitigation strategies.

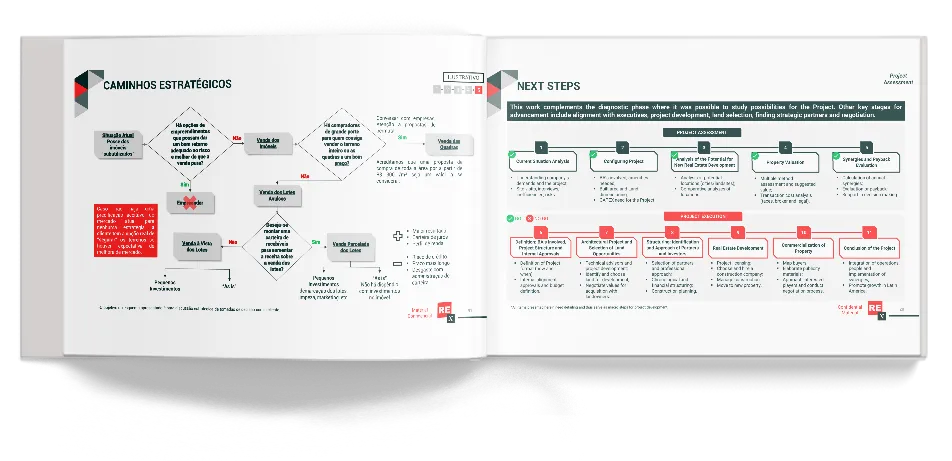

Strategic Pathways

How do you align the interests of the partners to enable the business to happen?

What is the best way to submit the business plan to an investment committee?

This stage consists of defining which format(s) may be viable for the business and how it can be followed up. We format a complete and didactic book featuring:

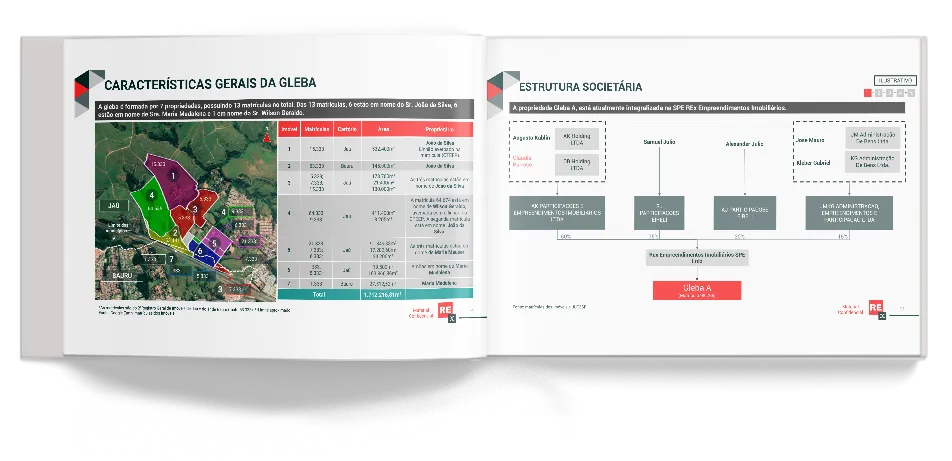

- General aspects of the real estate portfolio or property under analysis;

- Technical-environmental information gathered;

- Legal information about the property's documentation;

- Market Research with information analysis;

- Economic and Financial Feasibility Analysis;

- Mindmap elaboration with strategic paths based on the results presented;

- Presentation to the Investment Committee and alignment of stakeholders' interests;

- Considerations and suggestions for the next steps of the business.

We present the complete development visioning and economic master planning report with all the results that will allow the client to make decisions based on data, pondering potential risks and returns tied to its business. Often this scope evolves to Business Advisory ones.

2 Financial Analytics & Modeling.

RExperts is a leading reference in commercial real estate modeling in the Brazilian market. Structure the economic-financial model of your business plan, in an iterative process of premises alignment, enabling the project to be well evaluated and the financial resources to be used efficiently.

Using the most sophisticated techniques in the projection of cash flows, varied valuation methods, calculation of economic and financial indicators, and sensitivity analyses, we go beyond the typical property appraised value.

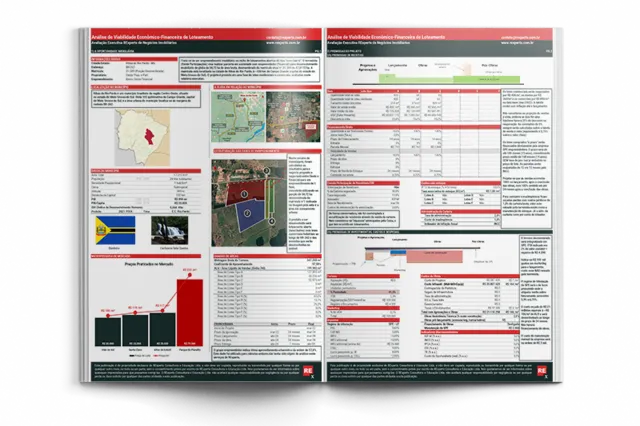

Business Data and Assumptions

Iterative alignment of the assumptions with the client, which will form the basis of the project's economic-financial model. This stage involves:

- General Project Information

- Distances in the State

- Municipality Data

- Simplified Market Research

- Site Images

- Table of Areas and Usages

- Development Timeline

- Investments, Costs and Expenses

- Commercial Assumptions

- Partnership Assumptions

- Involved parties (investors/ creditors/ developer/ land owner)

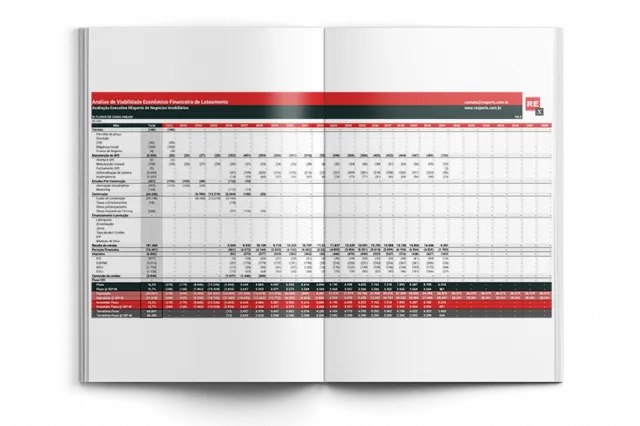

Projected

Cash Flows

Modeling of the projection of the enterprise's cash flows in detail. Some assumptions used, which may vary depending on the project and type of investment, are:

- Land, Registration Costs, Property Transfer Tax and Diligence

- SPV Maintenance and Portfolio Administration

- Designs, Licensing, and Marketing

- Construction Costs, Fees and Emoluments

- Financing or Securitization

- Sales, Swap, and Lease Revenues

- Taxes involved (RET - Special Taxation Regime / Presumable Profit)

- Sales/Leasing Commissions / Brokerage Fees

- Cash Flows of the Project and its participants

Commented Indicators and Charts

We present the simulations in an illustrative and didactic way, to better understand the results and provide insights into possible improvements in the project, such as strategies to reduce cash exposure and risk mitigation.

- General Project Information

- Income Statement

- Real Estate Project Indicators

- Project and Company Cash Flows Chart

- Cash Exposure Chart

- Internal Rate of Return (IRR)

- Required Cash Exposure

- Multiple of Investment (MOI)

- Net Margin

- Leverage

- Sensitivity Analysis

Key Questions

- How will the entrepreneur conduct the business plan analysis?

- Is there economic-financial feasibility for the idealized project?

- How will the cash flow and financial balance be planned?

- What will be the cash exposure for the realization of the business plan and with what disposition in time?

- What is the potential revenue generation of the project?

- What is the price range that an entrepreneur can offer to buy an asset and still maintain its profitability?

- What are the terms of a possible swap offer (physical or financial swap, amounts involved, potential return, terms, etc.) that are adequate from an economic-financial point of view?

- What are the structure options that generate the most value to the business participants? What are the risks of each of them?

- What is the potential generation of the business results for the entrepreneur, investor, creditor, and landholder?

- How will different investment scenarios be analyzed? What would be the result in a pessimistic/optimistic scenario?

3 Business Advisory.

Professionalize your business with advice on negotiations for the purchase and sale of commercial real estate and other real assets, corporate structuring of enterprises, swaps, fundraising, debt and operations such as built-to-suit, sale-and-leaseback and securitization. To do so, we offer the necessary support and planning that will give agility and fluidity for the accomplishment of the venture.

Structured Operations

How to choose business partners and assess their professionalism and reliability?

What is the best way to approach them and negotiate terms?

How much is an attractive return for the investor, creditor or the strategic partner?

What investment terms and conditions (rates, forms of amortization, guarantees, equity participation, etc.) are negotiable?

What are the business structuring procedures and schedules involved?

What is the most appropriate format for structuring this process (contracts, partnership structures, investment vehicles, etc.)?

We work from the prospection of deals, potential sites, clients, and investors to the structuring of the business with feasibility reports, brokerage, search for partners, elaboration of contracts, societary organization, tax optimization, and project execution for operations, such as:

- Built-to-Suit (BTS) / Built-to-Own (BTO)

- Sale-and-Leaseback

- Complex Debt Structure (e.g. customized debentures)

- Securitization of Receivables

Business Development Coordination

How will the entrepreneur conduct his business plan? What is the most appropriate format for structuring this process?

What are the resource requirements to materialize the infrastructure of the projects and with what disposition in time?

What conditions will be demanded and offered to investors (partnership terms, amounts involved, potential return, deadlines, etc.)?

What are the business risks and how to mitigate them?

The scopes of real estate diagnostics and economic-financial feasibility foresee the possibility to evolve into a partnership of RExperts in the client's business. RExperts can contribute with its entrepreneurial expertise, network of contacts and broad knowledge of the real estate investment market and real assets to coordinate the execution of the defined Strategic Path:

- Clients with real estate property can count on our support in negotiating sales, swaps or partnerships with their properties with professional partners (developers, land developers, investment funds and companies in the rental business).

Large Asset Divestment Processes

How to evaluate my assets?

Am I making a good deal on the sale?

How to tax optimize the sale of the property?

How to optimize my portfolio of assets?

How to approach potential buyers and negotiate with them without hindering the deal?

Aimed at companies, funds, family offices and owners of substantial assets. We act as brokers and negotiators in divestment processes, with a solid basis for argumentation based on our specialized studies and on different pricing techniques. We use all our expertise to capture opportunities to maximize the value of the business by accessing the market in a professional manner.

Fundraising

How to raise funds to finance my venture? What are the existing options?

Is it possible to issue a debenture, CRI (Certificate of Real Estate Receivables), or bring new partners into the project?

Which one is the most suitable for my case?

Who are the possible stakeholders in my business?

How to present the project to a professional investment board?

What is the financial return required by the market for the proposed investment?

We coordinate fundraising (equity and debt) for projects and companies in the capital market. To accomplish this task, we first carry out an in-depth study of the project, going through all the business feasibility analyses. Then, if feasible, we perform the corporate structuring, elaboration of the business presentation material (Information Memorandum), definition of the vehicle/product for funding, elaboration of the capital call schedule and calculation of the financial return for the parties involved. In addition, we act throughout the entire process so that the negotiated terms are duly considered in the formal documents.

4 Mergers and Acquisitions.

RExperts brings its expertise in Real Estate and real assets to mergers, acquisitions and spin-off transactions, extracting maximum value from transactions involving companies in these sectors and in the negotiation of portfolios of assets, both on the buy-side and sell-side. The client support is structured with an "owner" approach in a strategic way, attentive to confidentiality and without conflicts of interest.

Pre-Deal

What is the current state of my company/asset portfolio?

What alternatives, strategies, and opportunities are available to the company?

What price and commercial terms are appropriate for selling/buying the company/assets?

Who are the possible interested parties/targets?

The first stage consists of a thorough assessment of the company or asset portfolio in question, along with detailed valuation analyses, synergy calculations, and market research. We present the strategic paths to the client, to understand the available alternatives and business opportunities.

At this stage we list possible targets of interest, taking advantage of RExperts' network of contacts, and prepare a "one page teaser", a brief material presenting the proposed business, to make a preliminary survey of the market's interest without revealing the name of the company.

Roadshow and Approach

Is there demand for the proposed deal?

How to prioritize and select the interested/target companies?

What is the best way to approach these companies and negotiate the deal?

How to evaluate the best option among the offers/counteroffers received?

Once we know the possible interested parties/targets, in this stage we prepare, together with the client, a complete presentation material of the proposed deal, and RExperts is in charge of scheduling presentation meetings for the interested parties, based on the prioritization of the players mapped. Thus, in this stage, the following activities are carried out:

- Contact with prioritized players

- Coordination of the roadshow along with the client

- Receiving and understanding the offers/counteroffers

- Evaluation with the client of the available alternatives

- Defense of requested values and commercial payment conditions

- Support in the choice of players to advance in negotiations

- Obtaining and managing the prospected proposals

- Support in negotiating and preparing the Memorandum of Understanding (MoU)

- Periodic follow-up reports

Evaluation of Offers/Counteroffers

What are the potential outcomes of the deal?

What payment terms and conditions are negotiable?

What is the best structure to perform the transaction?

What is the best deal for the client?

We perform the evaluation and equalization of the offers/counteroffers of greatest interest to the client, we settle on the best commercial terms and define the ideal structures of the transaction. Based on feasibility analyses, valuation calculations, and quantification of synergies, we understand the best deal for our client.

Due Diligence and Final Contracts

How do I ensure that the terms negotiated in the contracts will be implemented?

Which legal advisors should I hire?

Am I aware and sure of the terms I am signing?

Supervision and negotiation of the final terms of the transaction with support to the client in understanding the documents. We monitor the work of the legal advisors appointed to draft the final documents and contracts, contributing with RExperts' entrepreneurial vision and expertise in real estate investments to the exact implementation of the negotiated terms.

5 Private Equity.

We assist investors and management companies that want to invest in the real estate and real assets segment in every stage of the investment: deal prospection, feasibility analysis, partnership structuring, investment, and divestment.

Real Estate and Real Assets Investments

How to look for promising deals to invest in this market?

Does the investment in question meet all feasibility requirements?

What is the business' potential to generate results?

How will the analysis of different investment scenarios be carried out?

How to conduct asset divestment processes?

RExperts' expertise and extensive network in this sector provides a complete private equity case writing service, assisting investors and funds with a comprehensive scope of work:

- Prospecting and presentation of deals in the market

- Analysis of economic, financial, commercial, technical, legal and environmental feasibility

- Customized financial modeling

- Market research and reports

- Professional materials for presentation in investment committees

- Elaboration of the societary structure

- Coordination of investment and disinvestment processes